Iron Condors Dan Harvey Class (Enjoy Free BONUS John Bartlett - Scalping the Forex & Accurate Scalper system mt4 forex scalping expert advisor))

Click to enlarge |

|

Class Overview

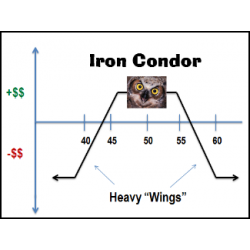

Class Description: Iron Condors are a great way to begin trading options – they are easy to understand, easy to trade, and easy to monitor. In this practical class Dan and his mentors show how to trade a variety of Iron Condors depending on the stock and market variables. They teach 8 specific methodologies for Iron Condor trading. You will watch as they put on 6 actual trades and see how they adjust the trades for maximum profitability before taking them off. Learn to fly with Condors – take this class today!

Class Format: This class is a collection of video recordings from the actual Live class that was previously offered. Once a student buys a class, an email is then sent, containing login credentials to access the archived class page. Typically, each class runs for four weeks, with two classes each week. Some classes contain additional videos and sessions. Purchasing access to a class gives access to all class recordings, as well as trade updates, PDF’s and PowerPoints. Any questions? Email us at missionx77@yahoo.com

Class Specifics:

- You are welcome to ask questions directly to Dan or another mentor

- Each class recording is a minimum of 1 hour, total of 10-12 hours approximately

- Supplemental videos on brokers (OptionNet Explorer, TOS Contingent orders)

- You can optionally purchase a 4-week trial of OptionNET Explorer for an additional 25 GBP

- All fees for online classes are deductible towards our GOLD Mentoring Program ($1000 limit)

Detailed Class Content

Class #1: With Dan Teaching, Different IC types and Insurance, 9 Day IC, and 44 day High Prob. IC. (delta of short call and put 10 or less.)

1- Intro and discussion on the student class page

11:20- Class Teaching: Iron Condor Reference Page on different types of Iron Condors and Insurance of Iron Condors

31- Class Trade: #1 High Probability Iron Condor (44 Days to Expiration) Iron Condor $1.70 Credit

58- Class Teaching: 9 Day Iron Condor with Adjustments Iron Condor Methodology #1 (I made a mistake titling this an 11 Day Iron Condor)

1:59 min- 2nd Class Trade 9 Day Iron Condor $1.42 Credit

Class Ends 2 Hr and 3 min

Class #2: With Dan Teaching, 9 day No Touch IC, 9 day IC with Adjustments, and 30 day IC with just the Put side and a debit spread overlay.

1- Intro and discussion what Dan will cover in this session

2:50- Class Teaching: 9 Day Iron Condor No Touch version (No adjustments) Iron Condor Methodology #2

14:25- Class Teaching: 9 Day Iron Condor with Adjustments Iron Condor Methodology #1 (Cleaned up and Clearer version)

(This is a cleaned up and clearer version of the 9 Day Iron Condor from Nov 5, just watch this one instead of Nov 5 presentation)

48- Class Trade Review: #2 Class Trade (originally discussed Nov 5 Class at 1 Hr and 59 mark): Trade up 10% and hit profit target after only 2 days!

55:50- Class Trade Review: #1 Class Trade from Wed Nov 5 Class and tried to put on live a similar trade as Class Trade #1. I put on a 42 Day RUT Iron Condor (Reference in ONE software 1a long term Iron Condor). And I was looking at a price of $1.57 Credit. This would be more of a High Probability type Iron Condor.

1:13-45- Class Teaching: High probability Iron Condor 30 Day Trade: Credit Spread on Put Side with Debit Spread Overlay also called ratio Iron Condor- Risk on 1 side only! Iron Condor Methodology #3

Class Ends 1 Hr and 50 min

Class #3: With Mark Fenton Teaching the Low Prob. IC. (delta of short call and put 14-16)

1- Intro and Outline for Today’s Class with Mark on Low Probability Iron Condors

6 min- Class Trade Review: (42 Days from expiration) Iron Condor in RUT from Nov 7 Class.

12:19- Class Trade:#4 Ratio Iron Condor: Call Credit Spread with debit Spread Overlay or Ratio Iron Condor (Friday Nov 7, we talked about this strategy from the put side). 202.5 Credit for this trade.

23:30- Class Teaching: with Mark Fenton: Iron Condor Methodology #4 Low Probability Iron Condor, 30-35 days from expiration. Using SPX and RUT for today’s teaching time.

1:16:40- Class Trade: #3 Low Probability Iron Condor (With Mark)

Class Ends 1Hr 20 min 59 sec

Class #4: With Dan Teaching his version of the Low Prob. IC. (delta of short call and put 14-16)

1- Intro and Today’s Outline

1:10 – Class Trade Review: #5 Class Trade GOOG Iron Condor (35 Days from Expiration)

33:10- Class Trade Review: #3 Class Trade Ratio Iron Condor Trade

51:30- Class Trade Review: Review long term Iron Condor initiated on November 7

53:20- Class Trade Review: #5 GOOG Class Trade initiated on Nov 14

1:01:08- Class Teaching: Dan’s Version of Low Probability Iron Condor (Little different version than what Mark taught, class today discusses differences) Iron Condor Methodology #5

1:55:50- Class Trade Review: #5 GOOG Class Trade initiated on Nov 14

Class Ends 1 hr 57 min 57 sec

Class #5: With Dan Teaching focusing on many different ADJUSTMENTS for the IC.

1- Intro and Today’s Outline

8:50- Class Teaching: Iron Condor Adjustments #5

1:15:40- Class Trade Review: #5 GOOG Iron Condor put on Nov 14

1:19:40- Class Trade Review: #3 Ratio Iron Condor (Couch Potato) put on Nov 12

1:22:35- Class Trade Review: Mark’s Low Probability Iron Condor put on Nov 12

1:25:40- Class Trade: AAPL Iron Condor (Think or Swim version where the delta of short call and put is between 25 and 30). Put on today.

Class Ends 1hr 39 min and 56 sec

Class #6: With Jay Bailey Teaching Narrow Strike IC (delta of short Call and Put 25-30)

1- Intro and today’s outline for Narrow Strike Iron Condor

3:15- Class Teaching: Narrow Strike Iron Condor Methodology #6 (also called Think or Swim version)

44:38- Class Trade: #7 Narrow Strike Iron Condor or Think or Swim Version put on today

58:40- Class Trade Review: #5 GOOG Iron Condor- Put on Nov 14

1:21:40- Class Trade Review: #6 AAPL Narrow Strike or Think or Swim Version Iron Condor, put on Nov 19

1:26:30- Class Trade Review: #3 Ratio Iron Condor put on Nov 12

1:55:20- Class Trade Review: Low Probability Iron Condor SPX (put on by Mark) trade initiated Nov 12

Class Ends 2 hr 8 min 55 sec

Class #7: With Dan Teaching 4 day IC. (No Adjustments)

1- Intro and today’s outline

1:35- Class Teaching: 4 Day Iron Condor SPX Iron Condor Methodology #7

48- Class Trade Review: #7 Skinny or Narrow Strike or Think or Swim Version Iron Condor put on Nov 21.

52- Class Trade Review: #6 AAPL Iron Condor (Narrow strike or Skinny or TOS version), put on Nov 19.

1:02:40- Class Trade Review: GOOG Iron Condor from Nov 14

1:20:40- Class Trade Review: Review SPX Ratio Iron Condor from Nov 12

Class Ends 1 hr 26 min 17 sec

Class #8: Final Class with Dan doing a class review and the 79 day Long Term IC.

1- Intro and today’s outline

17:30- Class Teaching: Iron Condor Class Review of the different Iron Condor Types covered in this Class. Dan went through each class and what Iron Condor Version was Covered. And what Iron Condor is best for you?

41:20- Class Teaching: 79 Day Long Term Iron Condor: Iron Condor Methodology #8

Class Ends 1 hr 23 min 42 sec

DOWNLOAD CONTENT:

John Bartlett - Scalping the Forex (Enjoy Free BONUS Accurate Scalper system mt4 forex scalping expert advisor)

103

$343 $35

English | 7h 46mn | 800 x 600 | WMV 1227 Kbps | WMA 48Kbps | 1.01 GB

Genre: eLearning

| “ | ” |

Scalping the Forex - On the CD, which was recorded during the worst financial crisis in most peoples living memory, I show how despite any situation you could expect to aim at a return of 5% per week. Not only is this a realistic target for you (dependent on your bank), it is totally under your control and fully achievable.

There are no gimmicks, magic formulas, secret equations, Fibonacci, Gann, Elliott waves, specialised indicators or other hyped up rubbish; Scalping is a skill which I teach you step by step in 12 different sections lasting nearly six hours.

You will see me teaching a “live” class in one section, in another I lay down strict trading rules, I teach you the mindset and how you get into the “Zone” I give you a live presentation section in which I trade on just 3 days in a week make 8 trades (7 winning and one losing) and make a return of £1,000 from a bank of £10,000 Tax free, and the total actual time in the trades was less than one hour.

The max risk on any trade was 2.5% of my capital. Your shown the importance of financial record keeping and analysing your trading. You are taught the importance of targets and running you’re trading like a business

Accurate Scalper system mt4 forex scalping expert advisor

The system is very easy and from the trades i've been doing on demo have been all profitable.

Here are the orignal rules:

----------------------

all other indicators are only guides to help decide to trade

1) When the bells sound consider a trade

2) Look at ISWPR indicator and only trade that direction

3) If you must use stops 15 is ok

4) if you are buying wait till the tick indi crosess up and selling visa versa

5) go for 5-10 pips.

6) Dont over trade I know its called scalping but its selective scalping I only took 2 trades on friday (got 10+ both)

-----------------------

The bell will start sounding when the big number in the right corner reaches 9..once it hits +10 Buy or -10 Sell.

Perky also added another indicator called the ADRTrader2 this will display buy and sell arrows.

the TF is M15 and currecy pair to trade is EURUSD.

generally best trading times is during london or NY sessions when market is more active.

This system is not a 'crystal ball' it cannot tell the future. What it does it tell you when there is a higher possibility of good trade. Some times you will win, sometimes you will lose.

Completing units:

![]() John Bartlett - Scalping the Forex

John Bartlett - Scalping the Forex

![]() Accurate Scalper system mt4 forex scalping expert advisor

Accurate Scalper system mt4 forex scalping expert advisor

Market Sales Price: $199,but we sell lot more lower than that to share the opportunity with you!

Serving Professional Traders Since 2008

Once purchased I will email you the files within 20 minutes and not more than 48 hours to your email, if there a delay, please be patience receiving your files

Your Review: Note: HTML is not translated!

Rating: Bad Good

Enter the code in the box below:

Categories

Categories Information

Information Specials

Specials

-38x38.jpg)

-38x38.jpg)

-38x38.jpg)

-38x38.jpg)

-38x38.jpg)

-38x38.jpg)

-38x38.jpg)

-38x38.jpg)

-38x38.jpg)

-38x38.jpg)

-38x38.jpg)

Featured

Featured

Shopping Cart

Shopping Cart Bestsellers

Bestsellers

-38x38.jpg)

-38x38.jpg)

![LR Thomas – Trading Forex High ROI Scalping (BONUS :Forex Scalping Strategy System v2.0 EA [Updated]) LR Thomas – Trading Forex High ROI Scalping (BONUS :Forex Scalping Strategy System v2.0 EA [Updated])](https://www.missionforex.com/image/cache/data/1.1/Trading Forex-120x120.jpg)

-120x120.jpg)